A Georgia man made national news recently when his former employer paid his final paycheck with a wheelbarrow full of oil-soaked pennies. While most employers stick to more conventional methods of payment, such as checks or direct deposit, even the most careful employer can get tripped up when an employment relationship ends. The federal Fair Labor Standards Act does not require employers to pay final paychecks immediately. Therefore, the laws vary considerably across the country.

Read more »Tag: wages

-

It Pays to Be Penny-Wise When Paying Final Paychecks Posted on: March 29, 2021 In: Labor & Employment

It Pays to Be Penny-Wise When Paying Final Paychecks Posted on: March 29, 2021 In: Labor & Employment

-

Fictitious Business Names on Wage Statements: An Invitation for Penalties in California Posted on: June 30, 2020 In: Labor & Employment

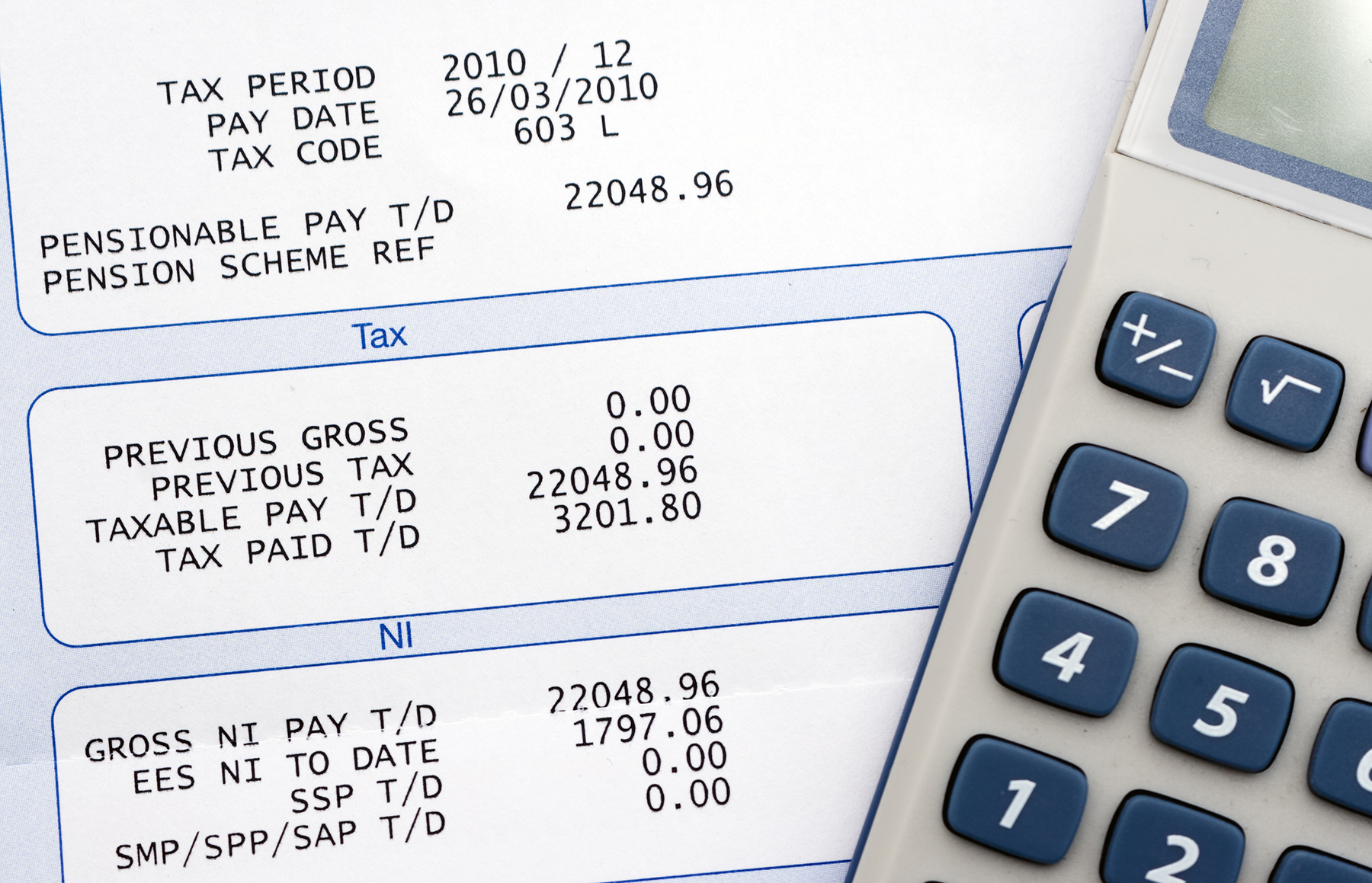

Fictitious Business Names on Wage Statements: An Invitation for Penalties in California Posted on: June 30, 2020 In: Labor & EmploymentComplying with California law on wage statements can be tricky for employers. Pursuant to Labor Code Section 226(a)(8), wage statements must identify the employer’s legal name. An employer can comply with this requirement by listing either the legal entity name or a registered fictitious business name (dba) on the wage statement. Failing to do so can expose employers to extensive liability on a class-wide basis through a class action or Private Attorney General Act (PAGA) representative action.

Read more »

-

5 Tips to Avoid Wage & Hour Liability in California Posted on: June 26, 2019 In: Labor & Employment

5 Tips to Avoid Wage & Hour Liability in California Posted on: June 26, 2019 In: Labor & EmploymentWage and hour litigation is an area of law that is incredibly nuanced, but incredibly important. Every California employer is faced with the daunting task of avoiding liability for wage and hour law violations. Fortunately, employers can greatly reduce the risk of exposure by following these five simple tips.

Read more »

-

4 Tips to Get the Most Out of Your Payroll Company Posted on: February 28, 2019 In: Labor & Employment

4 Tips to Get the Most Out of Your Payroll Company Posted on: February 28, 2019 In: Labor & EmploymentPayroll companies are often an invaluable resource in operating your business, but they can also be a source of frustration or, in the worst case scenario, potential legal exposure. Having worked with clients to help resolve payroll issues or defend litigation relating to payroll processing, we have a few helpful tips to ensure that your business is getting the most out of your payroll company and securing compliance with applicable employment laws.

Read more »

Blog Search

Featured Posts

- February 10, 2023 Historic Hermès Jury Verdict Paves Way for Digital Trademark Rights

- January 13, 2023 Sports Law: A Year in Review & What to Watch for in 2023

- January 06, 2023 Federal Trade Commission Cracks Down on Non-Compete Agreements

- December 06, 2022 Just In Time: Last Minute Compliance Tips for the CPRA and VCDPA

All Blog posts

All Blog posts