Sherlene Wong v. Stillwater Insurance Company

(Insurer Entitled to Summary Judgment Because Insureds Failed to Meet Their Burden of Establishing Direct Physical Loss Sustained by Embryos Caused by a Specific Peril Covered by Homeowners Insurance Policy)

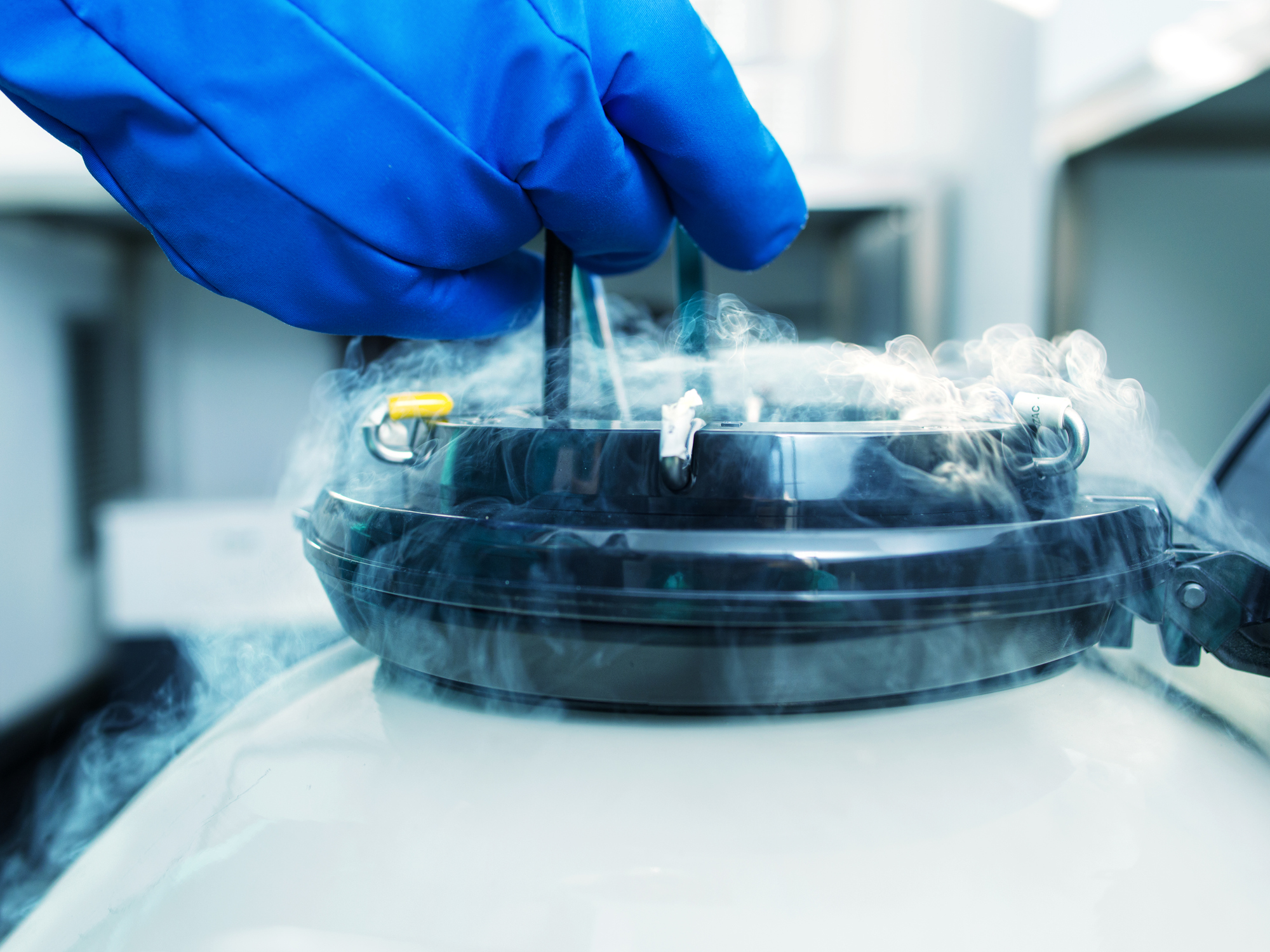

(September 2023) - In Sherlene Wong et al. v. Stillwater Ins. Co., 92 Cal.App.5th 1297 (June 30, 2023), the California First District Court of Appeal affirmed the trial court’s entry of summary judgment in favor of Stillwater Insurance Company (“Stillwater”) in connection with a claim for property damage made by insureds, Sherlene and Lawrence Wong (the “Wongs”), under a homeowners insurance policy. The Wongs contended their personal property coverage was triggered under their homeowners insurance policy in connection with the loss of three embryos stored in a cryogenic tank that used liquid nitrogen to store human embryos at very low temperatures. The seal in the tank failed causing the some or all the embryos to thaw. After consulting with their doctor, the Wongs determined that the embryos had been compromised and could not be used. Subsequently, the Wongs submitted a claim for personal property loss to Stillwater in the amount of $1,550,370 ($516,790 per embryo).

The insuring agreement for the Stillwater policy stated as follows:

“ENDORSEMENT A6140 07 15

“Under SECTION I—PERILS INSURED AGAINST, B. Coverage C—Personal Property, the first paragraph is deleted in its entirety and replaced by the following:

“We insure for sudden and accidental direct physical loss to property described in Coverage C caused by any of the following perils unless the loss is excluded in SECTION I—EXCLUSIONS.

“POLICY HO 00 03 05 11

“SECTION I—PERILS INSURED AGAINST

“1. Fire Or Lightning

“2. Windstorm Or Hail

“3. Explosion

“4. Riot Or Civil Commotion

“5. Aircraft

“6. Vehicles

“7. Smoke

“8. Vandalism Or Malicious Mischief

“9. Theft

“10. Falling Objects

“11. Weight Of Ice, Snow Or Sleet

“12. Accidental Discharge Or Overflow Of Water Or Steam

“13. Sudden And Accidental Tearing Apart, Cracking, Burning Or Bulging

“14. Freezing

“15. Sudden And Accidental Damage From Artificially Generated Electrical Current

“16. Volcanic Eruption

“There may be other reasons why coverage does not apply. We do not waive our rights to deny coverage for any other valid reason, which may arise.”

Because the Wongs did not provide any evidence of direct physical loss sustained by the embryos caused by one of the 16 perils listed in the insuring agreement, Stillwater denied coverage of their claim. Subsequently, the Wongs filed a lawsuit alleging various causes of action against Stillwater including breach of contract and bad faith. In response, Stillwater filed a motion for summary judgment arguing that the Wongs failed to meet their burden of establishing that the embryos sustained direct physical loss caused by one of the 16 perils listed in the Stillwater policy.

The trial court ultimately granted Stillwater’s motion. In doing so, the trial court sustained Stillwater’s objection to the Wongs’ use of an unsigned deposition transcript of an expert deposed in Colorado in another lawsuit addressing the cause of the failure of the cryogenic tank at issue in the Wongs’ claim. The expert testified that the tank’s failure may have been caused by an “implosion” due to an imbalance caused by the lack of pressure on the inside of the tank. The expert also referred to the tank failure as a type of “explosion.” The Wongs had not disclosed and designated this expert in their case. As such, the trial court sustained Stillwater’s objection to the use of the expert’s deposition testimony in opposition to its motion for summary judgment. Without such testimony, there was no evidence creating a material issue of fact relative whether the cause of the tank failure constituted an insured peril under the Stillwater policy.

In affirming the trial court’s decision, the Court of Appeal found that the Wongs failed to prove that the embryos sustained damage as a result of “direct physical loss” as required by the Stillwater policy. The Court of Appeal reasoned as follows:

The burden is on the insured “to prove facts establishing the claimed loss falls within the coverage provided by the policy's insuring clause.” (MRI Healthcare Center of Glendale, Inc. v. State Farm General Ins. Co., supra, 187 Cal.App.4th at p. 777 (MRI). As our Supreme Court has described, the insured's burden is “to establish that the occurrence forming the basis of its claim is within the basic scope of insurance coverage.” (Aydin Corp. v. First State Ins. Co. (1998) 18 Cal.4th 1183, 1188 [77 Cal. Rptr. 2d 537, 959 P.2d 1213].)

Here, as quoted, the insuring clause in the Stillwater policy provided that “we insure for sudden and accidental direct physical loss to property described in Coverage C caused by any of the following perils … unless the loss is excluded in Section I.” So here, as in MRI, the “accidental direct physical loss requirement is part of the policy's insuring clause and accordingly falls within the [insured's] burden of proof.” (MRI, ¬supra, 187 Cal.App.4th at p. 778.)

This, the Wongs failed to meet, beginning with their inability to demonstrate a direct “physical loss.”

Dr. Eyvazzadeh testified that she had requested Pacific Fertility to conduct a test of one of the Wongs' embryos, but that Pacific Fertility declined; and, she went on, there is “no way to know” whether the Wongs' embryos actually sustained physical damage. And having determined that there is “no way to know” whether the Wongs' embryos had actual physical damage, she deemed them to be “worthless” and “advised the Wongs that they should consider these embryos to have been irreversible compromised, no longer viable, and lost.” That does not create a triable issue of material fact as to “physical loss.”

Dr. Eyvazzadeh's concession there is “no way to know” whether the Wongs' embryos had actual physical damage was devastating to the Wongs' claim. And her conclusion that she deemed the embryos to be “worthless” was not a substitute for evidence that any of the embryos actually had undergone a physical change. Again MRI is apt: “‘Neither diminution in value nor the cost of repair of replacement are active physical forces—they are not the cause [**33] of the damage … [they are] the measure of the loss or damage.’” (MRI, supra, 187 Cal.App.4th at p. 780.) Put slightly differently, “‘Diminution in market value’ is not a ‘peril’ at all; it is a method of measuring damages.” (State Farm Fire & Casualty Co. v. Superior Court (1989) 215 Cal.App.3d 1435, 1444 [264 Cal. Rptr. 269].)

The mere possibility that the embryos had suffered physical damage was insufficient to create a triable issue of fact to trigger coverage. The Wongs had the burden of submitting evidence of actual physical alteration of the embryos. They did not, instead submitting evidence that there is “no way to know” whether such damage had occurred. “No way to know” was fatal to their claim, as it was in analogous cases. (See, e.g., Whittaker Corp. v. Allianz Underwriters, Inc. (1992) 11 Cal.App.4th 1236, 1241–1244 [14 Cal. Rptr. 2d 659] [insured conceded that it was “impossible to determine” when damage happened, and thus could not meet burden of proving damage occurred “during the policy period”]; Collin v. American Empire Ins. Co. (1994) 21 Cal.App.4th 787, 807 [26 Cal. Rptr. 2d 391] [insureds conceded they “‘do not know what happened to their property,’” and thus could not meet burden of proving loss was caused by “accident” as required by policy].)

In addition, the Court of Appeal found that the trial court properly sustained Stillwater’s objection to the use of the expert deposition testimony submitted by the Wongs in opposition to Stillwater’s motion for summary judgment, such that the Wongs did not meet their burden of establishing a material question of fact relative to whether the loss of the embryos was caused by a specific peril. The Court of Appeal reasoned as follows:

Here, as noted, the Wongs' position was that the loss was caused by an “explosion,” in claimed support of which they relied on the excerpt from Dr. Kasbekar's unsigned deposition in the Colorado lawsuit. The trial court ultimately ruled the excerpt inadmissible, and granted Stillwater's motion. This was correct. Before setting out the reasons why, we begin with some discussion of explosion, both in general and specifically as described in cases involving insurance.

Explosion is defined as “a violent expansion or bursting that is accompanied by noise and is caused by a sudden release of energy.” (Webster's 3d New Internat. Dict. (1976).) As Dictionary.com defines it, [“[A]n act or instance of exploding; a violent expansion or bursting with noise, as of gunpowder or a boiler (opposed to implosion); [¶] [T]he noise itself: [¶] The loud explosion woke them. [¶] [A] violent outburst, as of laughter or anger; [¶] [A] sudden, rapid, or great increase: [¶] a population explosion; [¶] [T]he burning of the mixture of fuel and air in an internal-combustion engine”].)

The California Encyclopedia describes it this way: “An ‘explosion’ has been defined as a sudden, accidental, violent bursting, breaking, or expansion caused by an internal force or pressure, which may be and usually is accompanied by some noise. Similarly, it has been said that a common characteristic of an explosion is the sudden breaking of a confined substance, with varying degrees of violence, from its confinement as a result of an internal pressure. It has also been characterized as a rapid, sudden, and violent expansion of air or relinquishment of energy, causing a rupture and accompanied by a loid noise, not necessarily extremely loud.” (31 A Cal.Jur.3d Explosions and Explosures, § 1, p. 564.)

Turning to insurance cases, “explosion” is “‘what ordinary men, not scientists,’” understand it to be. (Roma Wine Co. v. Hardware Mut. Fire Ins. Co. (1939) 31 Cal.App.2d 455, 458 [88 P.2d 260].) As the United States Supreme Court long ago put it, “[W]hen the word ‘explosion’ [is] used in the policy, [the parties] are presumed to have understood the word ‘explosion’ in its ordinary and popular sense. Not what some scientific man would define to be an explosion, but what the ordinary man would understand to be meant by that word.” (Mitchell v. Potomac Insurance Co. (1901) 183 U.S. 42, 52 [*1321] [46 L.Ed. 74, 22 S. Ct. 22].) As a leading insurance commentary puts it, an “explosion” is “commonly defined as a sudden and rapid combustion, causing a violent expansion of the air and accompanied by a report or sound, and is caused by a sudden release of energy from an escape of gas or vapors under pressure.” (10A Couch on Insurance (3d ed. [**38] 2022) § 150.6.)

By contrast, there is what Dr. Kasbekar first mentioned in his exchange with counsel at his deposition—implosion. Implosion is defined as “the act of imploding; a bursting inward (opposed to explosion).”

“Implosion is a process in which objects are destroyed by collapsing (or being squeezed in) on themselves. The opposite of explosion (which expands the volume), implosion reduces the volume occupied and concentrates matter and energy.”

The Court of Appeal found that since the Wongs had not designated the expert who testified in the Colorado case as an expert in their case, they could not rely on such expert’s testimony to establish a question of fact relative to whether the cause of the cryogenic tank failure was due to a covered peril, i.e. an explosion.