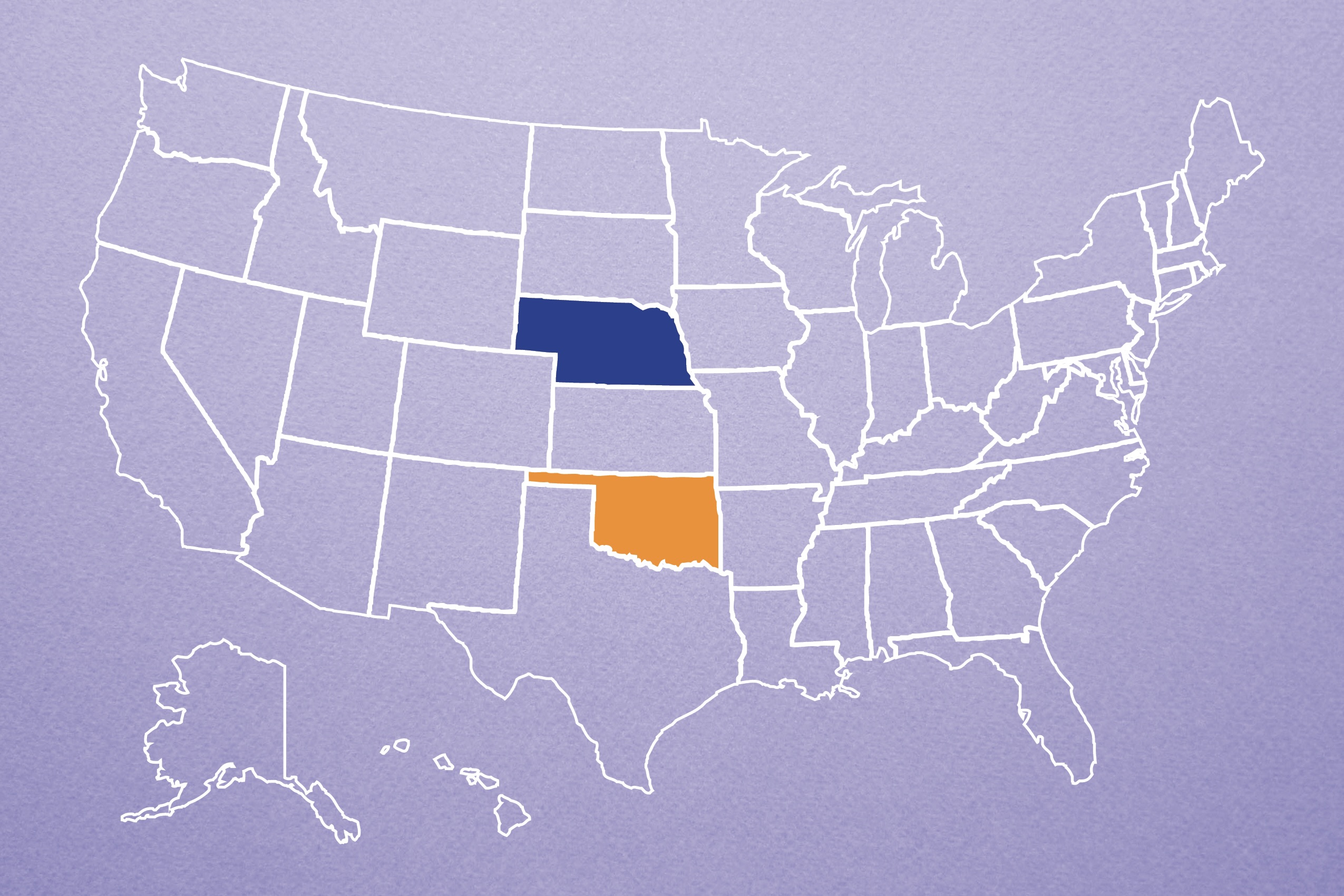

2022 Nebraska & Oklahoma Labor & Employment Law Year End Review

Kansas City, Mo./Wichita, Ks. (January 23, 2023) - There were a number of changes to the labor and employment laws of Nebraska and Oklahoma in 2022. In the Cornhusker State, these changes were initiated through ballot initiatives, legislation passed by the Nebraska unicameral, and case law decided by the Nebraska Supreme Court. Similarly, in the Sooner State, several new pieces of legislation were enacted that will impact both public and private employers. Highlights of last year’s biggest labor and employment law changes in these two states are summarized below.

Nebraska Labor & Employment Law Update

Minimum Wage

In 2022, Nebraska voters passed Initiative 433, a constitutional amendment, which will gradually increase the state’s $9 per hour minimum wage to $15 per hour by 2026. Over the next four years, Nebraskans will see an hourly wage increase of the following:

- $10.50 effective January 1, 2023 through December 31, 2023;

- $12.00 effective January 1, 2024 through December 31, 2024;

- $13.50 effective January 1, 2025 through December 31, 2025; and

- $15.00 effective January 1, 2026 through December 31, 2026.

Effective January 1, 2027, the state’s hourly minimum wage will have a yearly cost of living adjustment tied to the Consumer Price Index.

COVID-19 Vaccine Exemptions

On February 28, 2022, Governor Ricketts signed Legislative Bill 906, which allows employees to seek a vaccine exemption to any COVID-19 vaccine mandate implemented by their employer. Any employee seeking an exemption of the COVID-19 vaccine must obtain a Nebraska Department of Health and Human Services form, which includes a declaration that:

- A physician, physician assistant, or advance practice nurse (“health care practitioner”) has provided a signed statement that, in the healthcare practitioner’s opinion, receiving a COVID-19 vaccine is medically contraindicated for the individual; or

- A healthcare practitioner has provided a signed written statement that, in the healthcare practitioner’s opinion, medical necessity requires the individual to delay receiving the COVID-19 vaccine; or

- Receiving a COVID-19 vaccine would conflict with the individual’s sincerely held religious belief, practice, or observation.

The new law now requires employers to allow exempted employees to forgo any COVID-19 vaccine policies if that individual brings (1) a completed vaccine exemption form and (2) a copy of a written statement from a healthcare provider if the exemption is one based on the employee’s medical condition. The new law allows employers, at their own cost, to require periodic COVID-19 testing to the exempted employee and further allows employers to require the exempted employee to wear or use personal protective equipment, so long as it is provided by the employer.

Employment of Workers Under 16

In 2022, the Nebraska legislature loosened the reporting requirements of employers hiring minors under the age of 16. In Nebraska, any employer hiring employees under the age of 16 must keep an employment certificate and a list of such minors employed within the building on file for the Department of Labor to inspect. The amendments to these statutes reduced the number of lists that an employer must maintain from two lists to one. The amendments also require the employment certificate to be approved by the principal of the school in which the minor attends, instead of the school’s superintendent.

Increased Compensation to Public Safety Officers Killed in the Line of Duty

A 2022 bill passed by the Nebraska legislature will allow public safety officers to designate certain persons to receive compensation of $250,000 in the event that said public safety officer is killed in the line of duty. Like the minimum wage increase, this amount will also have a yearly cost of living adjustment tied to the Consumer Price Index.

Disability Discrimination Claim Precluded by Nebraska Workers’ Compensation Act

On September 9, 2022, in a case of first impression, the Nebraska Supreme Court addressed the exclusivity provisions of the Nebraska Workers’ Compensation Act in the context of a civil claim brought in district court under the Nebraska Fair Employment Practice Act (NFEPA). In the case, Dutcher v. Neb. Dep’t of Corr. Servs., 312 Neb. 405, 979 N.W.2d 245 (2022), the Nebraska Supreme Court held that a district court lacked jurisdiction over an injured employee’s NFEPA claim because the employee’s claimed discrimination under the NFEPA was a claim “arising from” a knee injury that was caused by an accident arising out of and in the course of her employment, and thus, the exclusivity provisions of the Nebraska Workers’ Compensation Act provided the sole remedy to the injured employee.

This decision departs from case law in other jurisdictions holding that the exclusivity provisions of the governing workers’ compensation laws do not bar discrimination actions based on a disability stemming from the personal injury for which workers’ compensation benefits were obtained. The Nebraska Supreme Court noted that the relevant workers’ compensation statutes in those jurisdictions generally lack the same “arising from” language found in the Nebraska Workers’ Compensation Act, and that those statutes often did not include injuries stemming from an employer’s intentional wrongdoing as the Nebraska Workers’ Compensation Act does.

Nebraska courts have recognized the “arising from” language of Neb. Rev. Stat. § 48-148 as “but for” causation and that “arising from” refers to a “rational nexus” between the claim and the workplace injury. Nebraska courts have held that the test, with respect to the “arising out of” employment under Neb. Rev. Stat. § 48-101, is whether the act is “reasonably incident thereto, or is so substantial a deviation as to constitute a break in the employment which creates the formidable independent hazard.” Under this analysis, the Dutcher court held that for the purposes of the Nebraska Workers’ Compensation Act, the employee’s claimed discrimination under the NFEPA was a claim “arising from” the knee injury that was caused by an accident arising out of and in the course of her employment.

The Nebraska Supreme Court noted that nothing in its opinion should be interpreted as restricting an employee’s ability to file a charge with the Equal Opportunity Commission or that discrimination is a rational or logical result of having a personal injury. However, in this case, the Nebraska Supreme Court found a sufficient nexus between the employee’s compensable workplace injury and her civil action under the NFEPA such that the NFEPA action arose from her workplace injury.

Oklahoma Labor & Employment Law Update

Public Employers

House Bill No. 3420 amended the Civil Service and Human Capital Modernization Act and the Oklahoma Personnel Act. Some notable amendments include revising the time period for which employee complaints must be filed from five business days to 10, and updating whistleblower reporting requirements for reporting agency or employee mismanagement and misuse of state funds or property to be specific to “criminal” misuse.

With respect to reductions in force, House Bill No. 3420 requires agencies to provide employees impacted by a reduction in force with severance benefits packages. Additionally, it eliminates the requirement that agencies give preference to veterans over non-veterans. Finally, it grants agencies authority to offer severance benefit packages to separating employees who are not subject to the Human Capital Modernization Act or a reduction in force if such employees release all claims against the agency and State of Oklahoma.

Senate Bill No. 1579 permits a school district board of education to approve an employee’s request for leave of absence to hold office. Such leave will be without pay, advancement on the minimum salary schedule, accrual of sick leave, personal business leave, or personal leave. Additionally, while on leave, the employee will not accumulate service credit within the Teachers’ Retirement System of Oklahoma.

Wages

Pursuant to Senate Bill No. 1345, employers are permitted to pay wages due to an employee by deposit at a financial institution of the employee’s choice or to a payroll card account if the employee does not consent or designate a financial institution.

Benefits

House Bill 1933 amends Title 40, section 2-106 by revising the method by which the maximum benefit amount is determined. Effective January 1, 2023, instead of the first factor simply stating, “twenty six (26) times the weekly benefit amount of the individual,” the first factor will state the following:

- If prior to January 1, 2023, twenty-six (26) times the weekly benefit amount of the individual,

- If between January 1, 2023, and January 1, 2025, sixteen (16) times the weekly benefit amount of the individual, or

- If after January 1, 2025, between sixteen (16) and twenty (20) times the weekly benefit amount dependent upon the state’s average unemployment insurance claims pursuant to Section 3 of the relevant act.

The second factor examined for the purposes of determining the maximum benefit amount largely remains the same.

Employment Security Act

House Bill 4413, effective November 1, 2022, amended the Employment Security Act to provide that “coemployer” means a professional employer organization or a client.

For more information on these developments, contact the authors or editor of this alert. Visit our Labor & Employment Practice page for additional alerts in this area.

Authors:

Toni Martin, Associate

Alexander DeMasi, Associate

Editor:

Alan L. Rupe, Managing Partner - Kansas City, MO & Wichita, KS

Related Practices

- Labor & Employment

- Employment Advice & Counseling

- Executive Compensation & Employee Benefits

- Traditional Labor